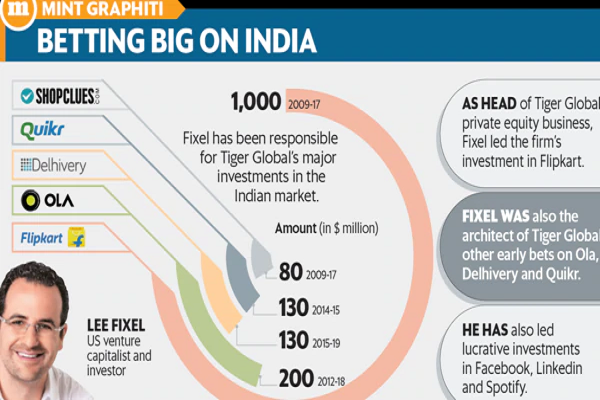

Lee Fixel, the former Tiger Global executive responsible for the firm’s most lucrative India investments, is set to return to his favorite stomping ground as early as next month; this time with his own money, three people directly aware of the matter said.

Fixel is looking to invest around $1 billion through his new fund, Addition, as soon as a non-compete agreement with his former employer expires, the people said, requesting anonymity. He plans to actively look at startups in India and also in South-East Asia, they said.

As the head of Tiger Global’s private equity business, Fixel led the firm’s investment in Flipkart. Walmart later bought a majority stake in Flipkart, giving the US fund its biggest pay-off in India so far.

Fixel was also the architect of Tiger’s other early bets on unicorns such as Ola, Delhivery and Quikr. At Tiger, Fixel was known for his speed of decision-making, often writing a fat cheque just after a brief Skype interview with founders. His aggressive investment approach took peers by surprise, but also earned him global attention.

He has also led lucrative investments in tech giants such as Facebook, LinkedIn and music streaming service Spotify.

“He (Fixel) has set up Addition to invest in tech startups in the areas where Tiger used to invest earlier, and more, and once the non-compete expires in a month or so, he will look at deals actively,” said a close associate and partner at a top venture capital firm.

Fixel is already in talks with a few Indian startups to sign cheques. He has held conversations to invest personally in a $24 million seed round at fintech startup Amica Technologies, said two people close to the development, separate from the three cited earlier. Amica has been founded by Jitendra Gupta, a former managing director at Naspers-owned PayU India. Sequoia Capital and Matrix Partners are expected to invest as well, The Economic Times reported on 9 August. Gupta declined to comment.

A spokesperson for Fixel confirmed the development, but declined to comment on specific deals and plans. Tiger informed its investors in a letter in March that Fixel might invest his own money and is expected to start a fund.

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter.

"Exciting news! Elets technomedia is now on WhatsApp Channels Subscribe today by clicking the link and stay updated with the latest insights!" Click here!