The word ‘digitalization’ is taking the world by a storm, opening new possibilities in the realms of accessibility, device capability, and monetization through various platforms and support systems. It is revolutionizing the way enterprises and customers interact. Today, India is on the growth path with innovation and digitalization, brimming with the potential to create an ecosystem to support digitalized growth. However, there is a major section in the country with low digital literacy and limited internet penetration. To tap the full potential of digitalization, we need to serve the rural regions and empower them to make the transformation more effective and inclusive. This is where the merchant networks play an effective role in building a bridge between the customers (especially from the rural region) and the digital services.

To better understand this, let us look at a simple example. A rural shopkeeper named Sahil has been selling essentials required by the residents of the vicinity. Through some means, he becomes aware of the concept of merchant banking which brings him extra remuneration whilst expanding his areas of service. Naturally, he registers on the platform enabling him to provide a plethora of digital banking services such as money transfers, payments, recharges, bookings, and more. Such services truly help the rural masses in accessing banking services whilst educating themselves about the digital world.

Highlighting doorstep banking

The merchant network caters to initializing doorstep banking in areas with no internet connectivity or accessibility to digital services. The banking services include fund transfer via Aadhar authentication, cash collection, opening an account, and more. Apart from the banking services, merchants also provide value-added services including bill payments, loans, insurance, recharges to the unbanked areas.

Doorstep banking furthers the rural population to accept formal banking.

Business Correspondents Brings a Revolutionary Change

Earlier, India was known to be an under-banked country with the challenges of reaching out to the financially underserved population with banking services. The primary reason for this was that most of the transactions were cash-based only. This meant a lot of paperwork and reduced efficiency. Another aspect to consider is the lack of banking infrastructure in the rural and remote regions of the country.

Hence, the government came up with the Banking Correspondent (BC) model to strengthen the system through efficient technology. This model involves agents who act as the extended arm of the bank to reach every corner of the country and provide the required banking services. The BC model eases the provision of digital financial services.

What the numbers are saying?

The recent report by JP Morgan on 2020 E-commerce Payments Trends Report: India indicates that there are more than 40 billion merchant networks in India accepting online transactions and creating newer avenues in the digital age. This is possible through the rapid integration of internet usage and access in everyone’s lives. In the urban areas, there are approximately 293 million active internet users while in rural areas there are approximately 200 million active internet users.

What do merchant networks introduce?

Merchant networks build trust amongst the customers as they are from the local community and are aware of customer requirements and needs.

Merchant networks also increase the outreach of banks and identify potential customer base for them by educating the masses to a great extent. In effect, they reduce the cost incurred by the bank in setting up and managing a brick-and-mortar setup whilst providing employment to the rural population.

Hence, these networks have bolstered these regions to level up and contribute to the economy almost as much as other regions.

Given the effectiveness of these networks for creating digital awareness, the government and financial institutions must contribute towards sustaining the momentum. With increased co-operation between them and the merchants on ground, a robust and efficient system can be developed which will truly drive the country’s financial inclusion to its utmost potential, creating a highly growth driven economy.

Authored by – Mr. Jay Goel, Business Head-SahiPay, Manipal Business Solutions.

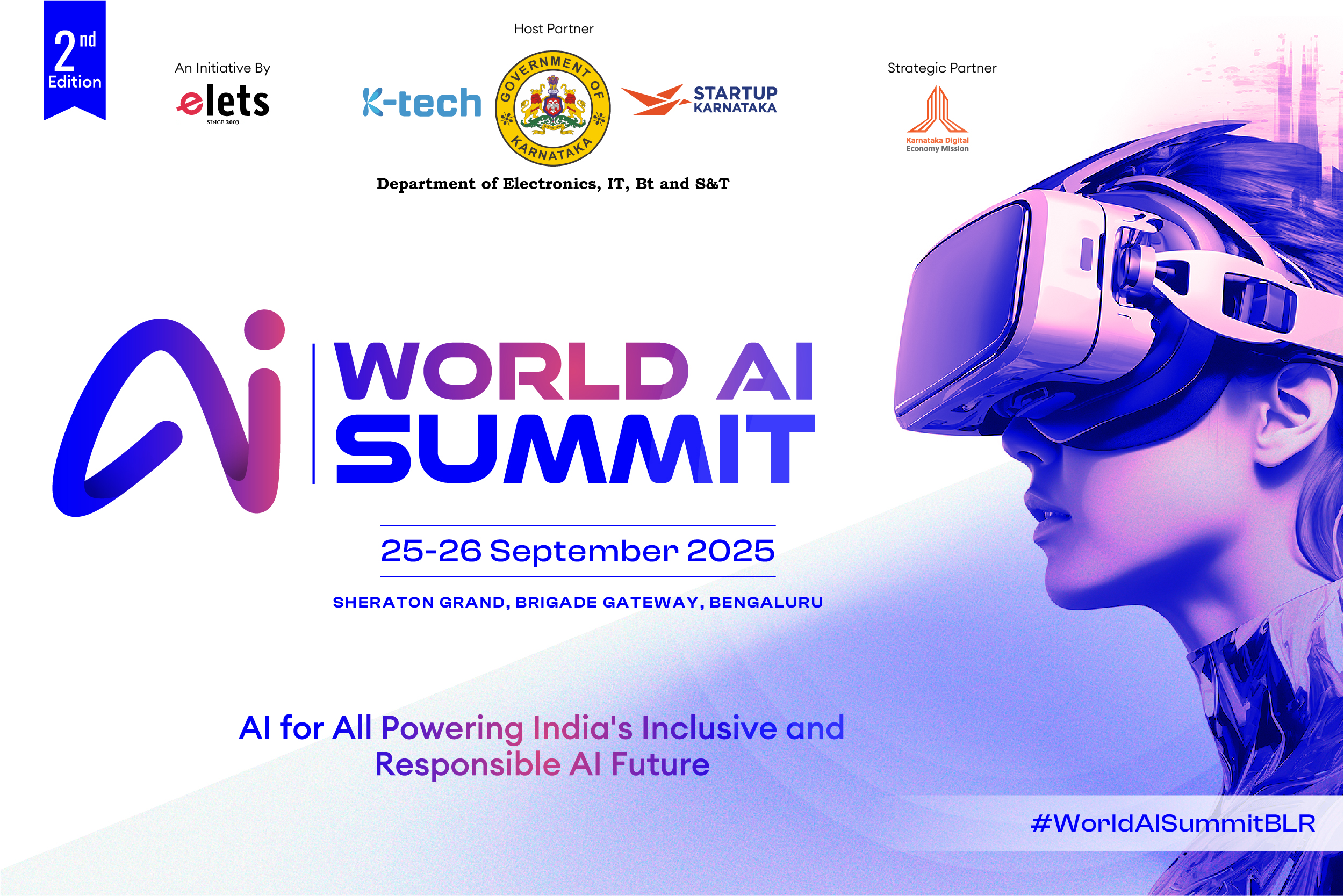

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter.

"Exciting news! Elets technomedia is now on WhatsApp Channels Subscribe today by clicking the link and stay updated with the latest insights!" Click here!