Those who stand at the helm of financial services share a vision of a secure online ecosystem. An environment wherein consumers can use digital solutions and advanced technologies to manage their finances. India has witnessed increased adoption of digital processes and technology solutions across all customer segments. While the ease of use might differ; it is no longer restricted to the tech-savvy population.

But before we take pride in our swiftly evolving financial services, we must remember that financial fraud is also evolving – perhaps quicker than we would like. In the financial year 2021-22, internet fraud in the financial services industry amounted to INR 155 Crores in 3596 cases. In 2020-21, this figure was INR 119 Crores in 2545 cases.

Clearly, fraudsters are ramping up their activities. As more people move their financial endeavours online – the possibility of fraud increases. And our vision of a flawless fintech ecosystem may never eventuate if we don’t innovate today and equip financial services with cutting-edge solutions for fraud prevention.

The Unending Threat of Identity Theft

In recent times, we have witnessed identity theft emerge as a prominent threat in the Indian market.

Identity theft hampers our industry’s efforts for financial inclusion, undermines the trust our stakeholders place in our systems, and violates their privacy. Fortunately, we can find answers to fraud prevention challenges in technology. Not just technology for cybersecurity but advanced security solutions integrated with your customer onboarding processes in a 360-degree fraud prevention strategy.

The Role of KYC in Fraud Prevention

KYC or ‘know your customer is a well-established method for due diligence in financial services. Governments worldwide urge financial institutions to develop KYC procedures that detect and protect financial misdemeanours like –

Identity Theft – Identity thieves steal vital pieces of personal information and use them to impersonate one or more customers and commit crimes in their name.

Financial Fraud – Creating accounts using stolen identities, unauthorised login to bank accounts, account takeover, and unauthorised financial transactions.

Money Laundering – Setting up dummy accounts to disguise the origins of the money obtained through illegal means.

A thorough KYC allows the financial institution to assess a potential customer’s risk classification. KYC is responsible for verifying a customer’s identity and can help in successful anti-money laundering compliance. It mitigates the risk of financial fraud and builds trust to build a good business reputation.

It is essential to mention that financial services operate in a dynamic and competitive business environment. Institutions are constantly pressured to improve their speed-to-market, offer positive customer experiences, and quicken their onboarding processes. In such cases, increasing KYC provisions in the system may increase the turnaround time if not addressed through optimal technology.

Our best bet is to enhance our KYC processes using technological innovation that fortifies our due diligence and improves customer experience.

How Does KYC Digital Verification Work?

KYC digital verification is a visionary technological solution for fraud prevention in our time. It can assist the financial services industry in combating crime and protecting customers’ personally identifiable information. In the digital age, where the customer needs secure and speedy financial solutions – KYC digital verification offers the perfect solution. Here are a few reasons why –

Digital Footprint Analysis – Get a 360-degree view of the customer profile by examining their digital footprint. New-age KYC software can analyse the digital footprint using their email address, IP address, and phone number.

Biometric Identification – Use KYC solutions that identify customers using biometric data. Biometric credentials are almost impossible to replicate and help prevent identity theft. Add an extra layer of security against scammers and fake identities.

AI-driven Data Extraction – Deploy APIs that seamlessly extract crucial customer information from your KYC database to enable instant and smart verification. Solutions to analyse KYC data for suspicious activity or anomalies can also help to detect fraudulent attempts timely.

Video KYC Technology – KYC solutions leverage liveness detection technology to verify customers in real-time. Leverage this AI-powered innovation to accelerate your onboarding process tenfold. It eliminates unnecessary paperwork and completes the KYC with in-built geolocation tracking. Financial services are moving faster than ever toward a world where digital financial transactions will become the primary commerce method. Businesses must consider the dynamic needs of their consumers while embracing technology and innovation to scale their services. KYC digital verification can prove instrumental in building a frictionless and secure digital experience while preventing financial fraud.

Authored by: Pratyush Chandramadhur, Chief Business Officer, AuthBridge Research Services

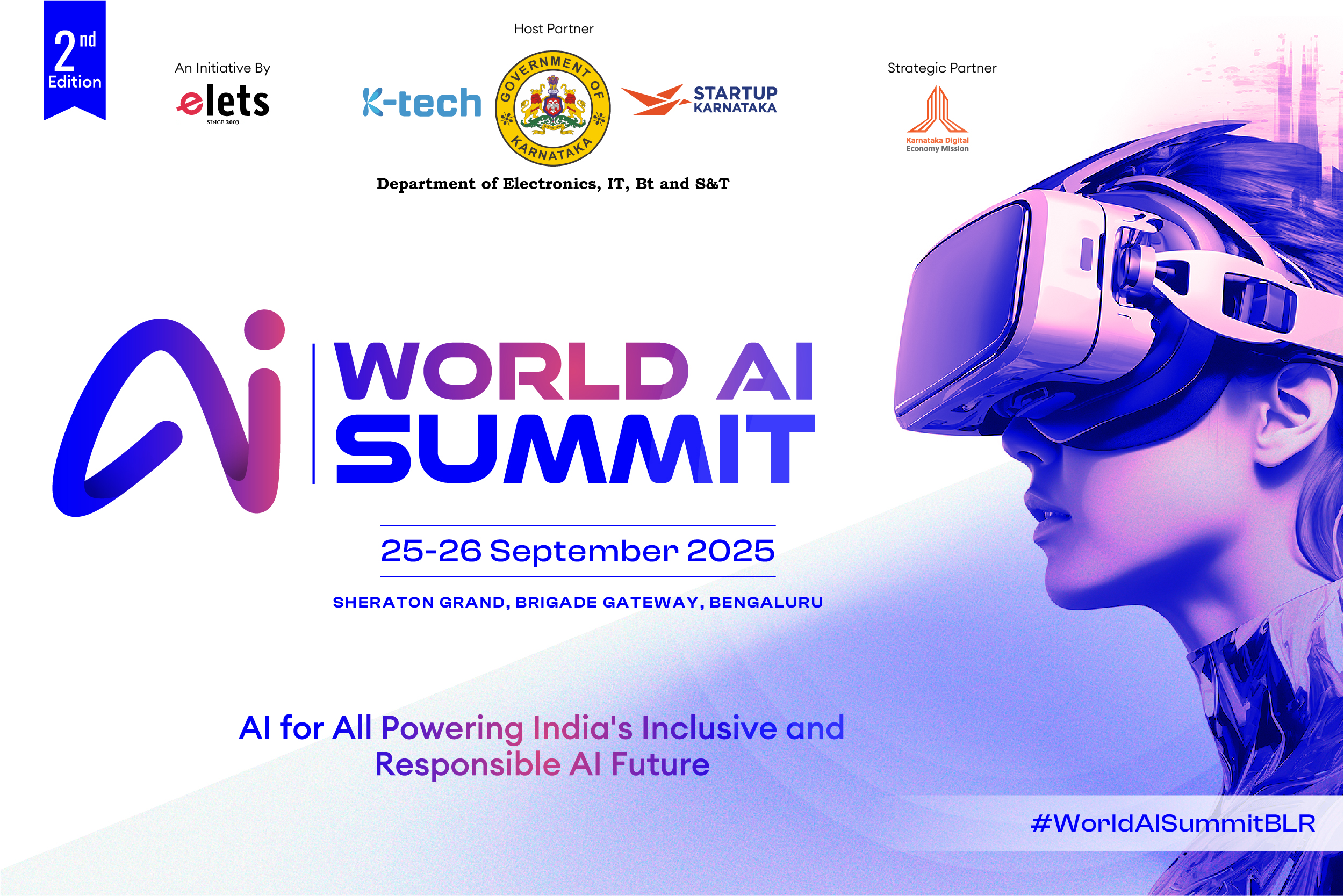

Be a part of Elets Collaborative Initiatives. Join Us for Upcoming Events and explore business opportunities. Like us on Facebook , connect with us on LinkedIn and follow us on Twitter.

"Exciting news! Elets technomedia is now on WhatsApp Channels Subscribe today by clicking the link and stay updated with the latest insights!" Click here!